Why is penetration testing so important? In today’s fast, digitizing world, cybersecurity has become a CEOs’ primary focus. Fintech Services, banking & insurance companies handling critical financial and personal information related to the users and employees are consistently threatened by cyber criminals.

Forbes conducted research in 2015 and found that cybercriminals target financial organizations 10 times more than other industries. In 2019, a similar survey proved that financial organizations experienced much more cyberattacks than any other firm.

How can Banks and fintech organizations get ready to protect themselves from cyber dangers?

The answer is by performing vulnerability assessment and penetration testing from time to time.

VAPT has a massive range of security tests to simplify the risk of addressing cyber security dangers across the information technology landscape of an organization. These tests have automated vulnerability tests, human-handled penetration, or ethical hacking tests.

BFSI organizations manage the most sensitive financial data about individuals, governments, and public or private corporations. All that data includes bank account numbers, national identification digits, credit card numbers etc.

Data theft in such organizations leads to financial losses, regulatory penalties and a lost reputation for the companies. That’s why most organizations mainly invest in cyber security infrastructure to confirm that their systems, apps and databases are protected from cyber threats.

Before COVID began, digitization was the primary trend in our BFSI industry. Besides the already existing digital firms, digital-only fintech organizations have appeared in the BFSI industry.

The prominent digital presence in this industry has made these organizations prone to cyberattacks. The wide range of access mechanisms like the web, mobile and wireless technologies have increased the vulnerability of financial institutes.

Besides their internal systems, banks also possess secondhand exposures that result from credit/payments card information being managed by organizations from other industries, like retail, hospitality, e-commerce websites etc.

These exposures have made VAPT an essential requirement for the survival of BFSIs.

Financial Services organizations are at the highest level of the regulatory focus for data protection, as they take care of sensitive nonpublic personal information.

What kind of threats do Financial Services organizations have to face at present?

The various modes of threat faced by financial services organizations are mentioned below:

Data that is unencrypted

The primary way to safely store data is with the help of encryption. Even now, encryption of sensitive data is never religiously followed across any organization; e.g., the data in test environments is always vulnerable to internal threats that are extremely dangerous.

Ransomware & Malware

We have noticed lots of ransomware & malware attacks happen on the top banking institutions and IT service organizations that function with banks. Most of these vulnerabilities concern internal employees connecting through infected machines or by mistake providing user credentials in phishing attacks. Forbes ransomware leads to $75 billion in damage to organizations each year.

The Cloud Providers

Cloud providers are now the central target of cyber attacks, as most BFSI organizations use cloud providers for storage and applications. The latest wall street journal report on an attack called ‘Cloud Hopper’ involved many cloud providers.

Unsafe third-party vendors & services

Whenever the outsourcing of technology and business process services remains the way it should be, the security practices in the 3rd party services organizations that work based on the systems become the primary source of vulnerability. Financial institutions also use plenty of 3rd Party services organizations that function on the systems and are a significant source of danger for all fintech institutes.

The method of Phishing & Spoofing

In this method, different duplicate banking websites made by hackers fool customers into revealing their user information. Afterward, hackers use these credentials to steal data from personal user accounts.

IoT

Hardware is new for the vulnerability that cyber-attacks have begun to focus on. Devices like home routers, printers, and cameras are prone to attack.

As we have noticed the various dangers faced by financial organizations, it is essential to learn more about the services offered by VAPT Testing.

You can also go through our blog on How to conduct a network penetration test? Example and Tips.

What services comprise VAPT Testing?

A vulnerability assessment is an adequately planned review of the weak areas present in the information technology landscape. The assessment has servers and hosts and network wireless infrastructure databases.

Applications have internal and external facing apps

Vulnerability assessment helps organizations know about the flaws in their apps, hosts, databases or networks. It never specifies the vulnerabilities that need to be exploited to cause losses. This is where the role of penetration testing comes to the forefront.

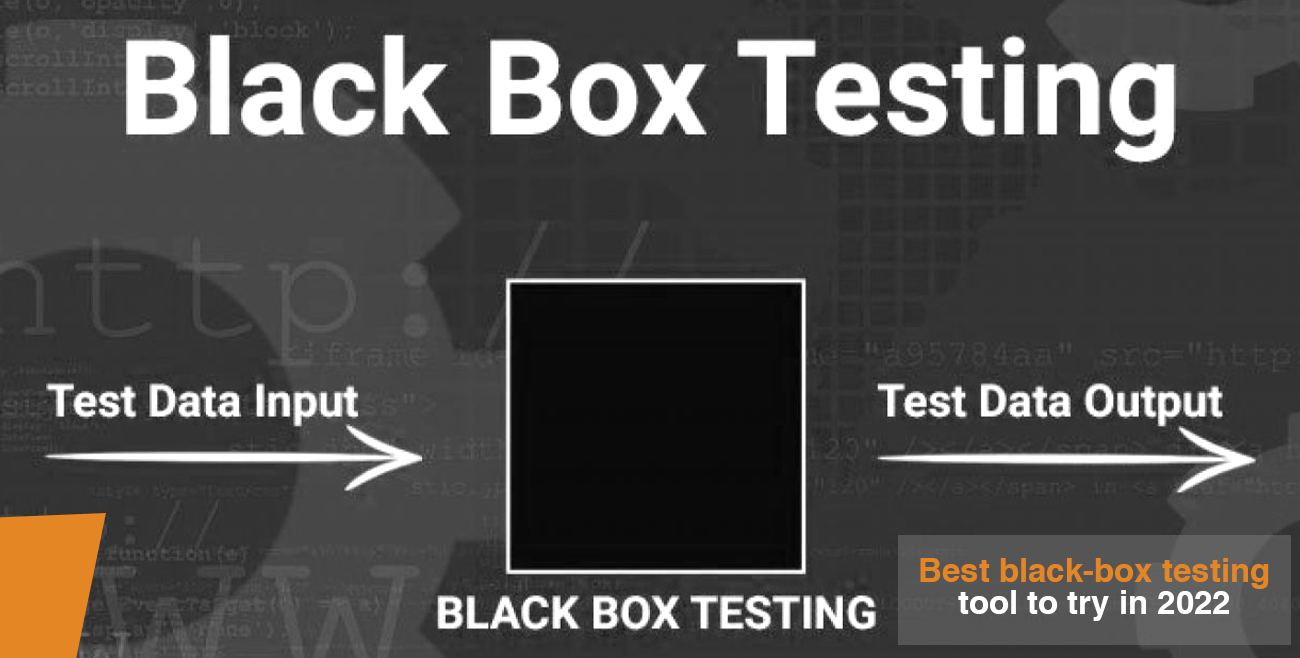

Penetration Testing tries to exploit these vulnerabilities and allows the organization to understand how severe these vulnerabilities are.

Penetration Testing has a combination of automated and human-driven tests for recognizing and exploiting these vulnerabilities in the infrastructure, external facing as well as internal facing apps and other systems.

The last but not the most minor thing is that IoT devices have added a new hardware angle to the cyber threat. This is why organizations involving remote-home- or office-based work must include IoT devices within their VAPT testing.

That’s why Vulnerability Assessment and Penetration Testing come together to give a detailed view of the shortcomings in an organization’s systems and the losses that these flaws can expose.

How frequently do organizations conduct VAPT?

The best practice in the industry is to notice that you can run a VAPT at least once a quarter on various host systems, apps, databases and network infrastructure.

Other than the periodic tests, all web and mobile app development projects should pass through VAPT to confirm that the new, improved app does not bring dangers into the landscape.

Concluding Thoughts

Security testing and web app penetration testing unravel all the dangers the apps might face. Ensure that the application risks are brought down and the benchmarks for your software code for greater quality assurance are appropriately set. Our security testing services across numerous industry verticals & enterprises take care of cyber security, resulting in a positive brand image & high client retention rate. hikeQA is a top provider of all qa testing services. Don’t hesitate to reach out to us for any help or support.